Auto Finance Vs. Lease: Everything you need to know before and after

Introductions:

Auto Finance Vs. Lease: Everything you need to know before and after, When I was working at my previous employer, we had a program for teaching employees how to manage their finance, Debts, credit score, Weight management, etc. in this post I’m sharing what I have learned and also a part of my experience in the car dealership to help you make the right decision to either finance or lease and if you also need Gap coverage when you lease a car and some general information regarding insurance and mechanical breakdown.

I know the information in this post might confuse you, so don’t hesitate to comment your questions below, and let’s have a conversation going.

Car Payments vs. Total Transportation Costs

⇒ If you only think about your “payment” you may find yourself car poor like many Americans.

⇒ It’s necessary to take it to the next level and think about total costs (monthly):

Total Monthly Transportation Costs

1. Loan Payment or Lease Payment

(Downpayment /Length of Drivable Ownership)

+

2. Insurance Premium

+

3. Maintenance Costs Averaged on a Monthly Basis

+

4. Fuel Costs

Leasing (Brand New)

Down Payment (Capital Reduction) + Expected Deprecation(You Pay) + Interest (Called Money Factor) + Fees, GAP, Overages

⇒ Title and registration in leasing company’s name.

⇒ Fixed amount of time/mileage you have ownership. You are not free to sell/trade in the vehicle anywhere.

⇒ Have to have full coverage insurance, typically must have GAP insurance.

⇒ You end up with nothing in the end.

Leasing Jargon:

1. Residual Value predicted value at end of lease of the vehicle. Determines where the other numbers fall

2. Capitalized Cost In Leasing World, this is vehicle price.

3. Money Factor interest rate?

• Lower number is better.

• Multiply by 2400 to get the approximate interest rate.

Owning (Auto Financing)

Equity (Ownership) + Expected Deprecation (You Pay) + Interest, Financing Fees + GAP, Warranties, Etc.

⇒ Buying the vehicle with cash or getting a loan. Paying for ownership of the residual value of the vehicle, the depreciation, and interest/fees.

⇒ Even though you have a “lienholder”, you still own the vehicle and it is registered in your name.

⇒ You have the right to do anything you would like with/to the vehicle (unless it infringes on your lienholder’s rights)

⇒ You own the residual value at the end of the loan (if you get a loan).

Items to Consider:

1. Price of Vehicle

2. APR of Loan

3. Expected Depreciation of the vehicle

4. Extras GAP & Warranties

Owning Vs. Leasing Differences

⇒ When leasing, you don’t pay for the equity (ownership). As a result, you don’t own anything at the end.

⇒ Leasing restricts your freedom to do things much more than an auto loan. (Sell, trade-in, modify the vehicle, drive high mileage, etc.).

⇒ Leases typically have lower payments.

⇒ There is different jargon (terms) for things with each route, but the only real difference in the financing equation is the equity portion that you don’t pay for with a lease (and as a result don don’t have anything at the end).

⇒ In a Lease, you will have to have GAP protection (more on this later).

⇒ In Ohio (for instance), you will pay a portion of each of your lease payments to tax. In some states, you have to pay the sales tax for the entire value of the vehicle just to lease it!

Owning Vs. Leasing Considerations

1. Time (biggest consideration) – how long do you plan to have the vehicle?

• If you can properly maintain a vehicle you own for long enough and aren’t concerned with always having a new vehicle, you can reduce overall monthly ownership costs by having the car without a payment. This leaves you with only insurance, maintenance, and gas costs.

2. Mileage – how many miles do you typically drive in a year/month? If you drive more than the average person, leasing is probably a bad option for you. Exceeding lease mileage is always a very expensive proposition (15 20 cents per mile).

3. Consider Maintenance Costs – some leases include some maintenance costs while others may not. If you are leasing, you are typically always driving a newer car under warranty, so maintenance costs should be lower, but that doesn’t mean you will never have to spend money on maintenance.

Owning Vs. Leasing Example

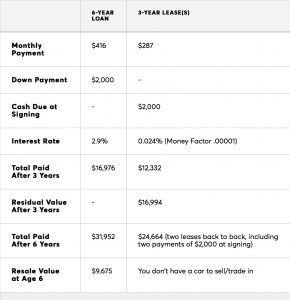

Consumer Reports example of a 2017 Mazda CX 5 lease vs buy.

Auto Financing Vs. Leasing Differences and Considerations

〉〉 The vehicle costs $29,429

〉〉Two back to back 3-year leases vs. 6-year loan

〉〉A loan is 6 years (pretty typically these days)

〉〉The interest rate on loans is 2.9% (very low).

〉〉$2000 is put down in both

〉〉Maintenance costs are not considered.

The buyer comes out ahead $2387.00 in this limited example.

Where People Get Auto Loans

1. Dealerships (this is what most people do the dealership works with the banks on your behalf)

• Dealer gets a “cut” of the loan interest, “sells” loan to banks/credit unions.

2. Credit Unions!

• Not-for-profit financial cooperatives owned by their members. Often the lowest rates. Allow you to get pre-approved before you pick the vehicle, help you through the process, etc.

3. Online Only Lenders

• Specialty auto finance companies. Startups/other online options (Check out Carvana)

4. Some Banks do Auto Loans Directly, cutting out the dealer. Many big ones don don’t.

How Auto Loans Work

The financial institution presents the dealer with the funds for the full vehicle purchase on your behalf (minus down payment) with instructions to place a lien on the vehicle. The vehicle is titled in your name but you will only receive a memorandum title until you pay off the loan (showing that the financial institution has a lien).

Components of the Loan:

A. Principal Amount (Price + Taxes + Fees +Extras)

B. Annual Percentage Rate (Interest Rate)

C. Term

Results in:

A. Payment

B. Total Financing Charges

C. Total Amount Repaid

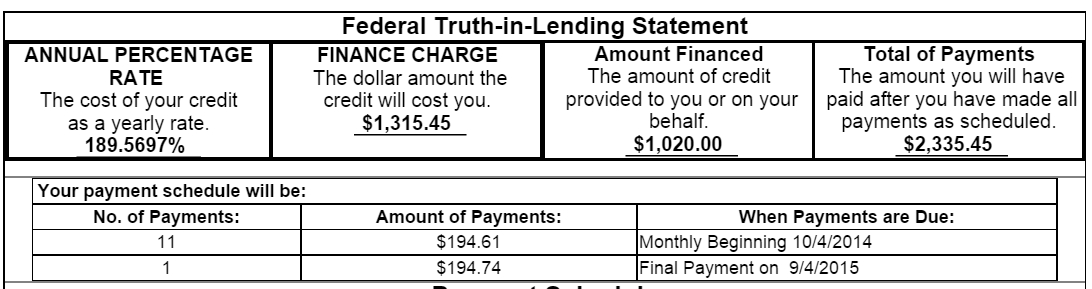

Example of Truth-in-Lending Box

Example of Truth-in-Lending Box | Auto Finance Vs. Lease: Everything you need to know before and after

⇒ This box is required by federal regulations to be on the loan paperwork

⇒ It communicates all the most important numbers of the financing.

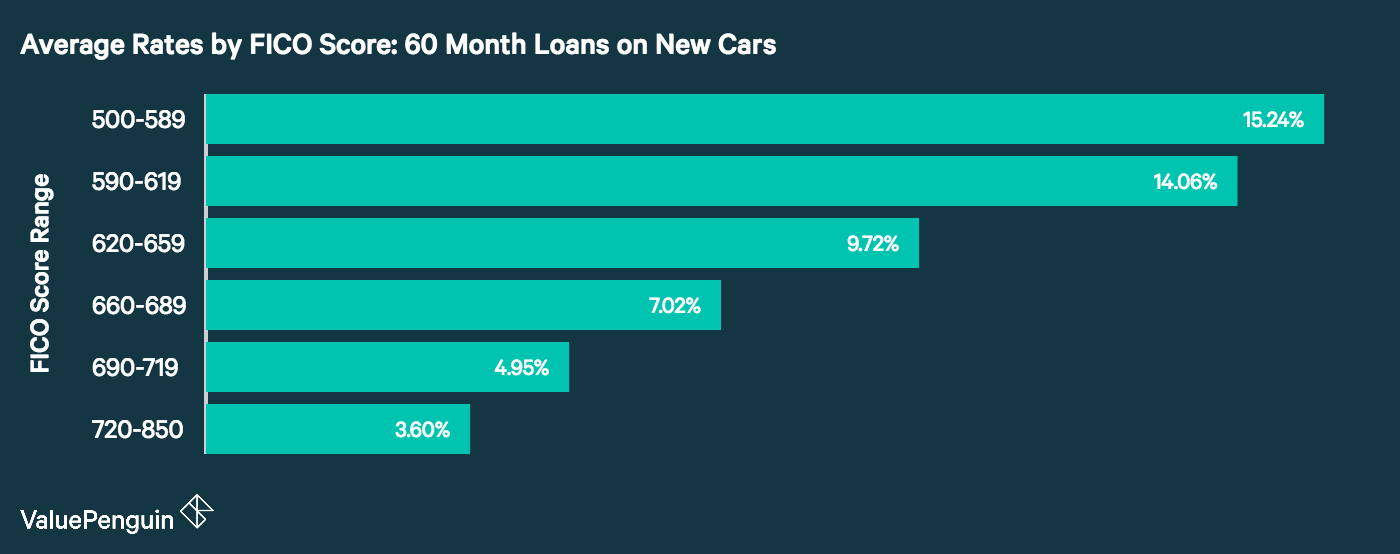

FICO Ranges and Loan/Lease Rates

FICO Ranges and LoanLease Rates | Auto Finance Vs. Lease: Everything you need to know before and after

⇒ Credit is checked for both loans and leases.

⇒ Pay down your revolving credit as much as possible and let those balances hit your statements before you go out shopping for credit (see the previous presentation on credit).

⇒ There is a ton of variance based on the lender, the borrower, the vehicle, the age of the vehicle, the term of the loan, etc.

⇒ For example, Towpath CU offers rates as low as 1.99% during our Auto Loan Promotion but the highest rates approach 25%.

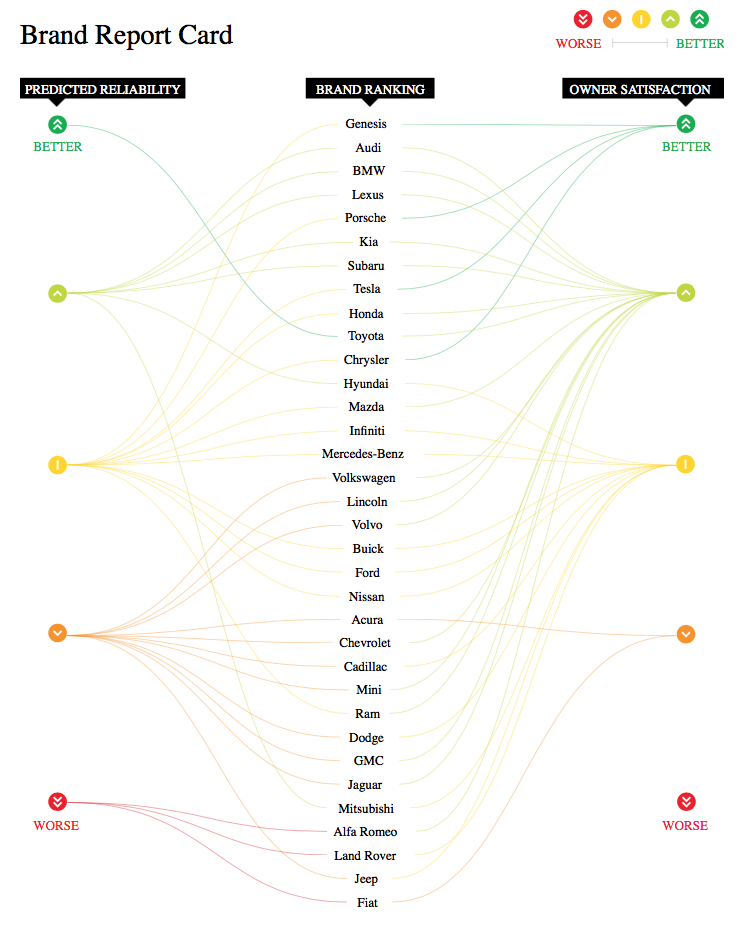

Considering Makes and Models

Considering Makes and Models in Auto Financing Vs. Leasing | Auto Finance Vs. Lease: Everything you need to know before and after

⇒ More than any of us is probably willing to admit, car buying/leasing is often driven by branding and emotion more than it is by objective decision-making.

⇒ That said, you should still do your due diligence about makes and models with the objective information available to decide what you are looking for before you step foot on a car lot.

⇒ After you narrow down a few brands that interest you, start to decide on models based on reviews on particular model years. (They can vary based on year greatly!)

Before You Buy

1. Vehicle History Reports

• CarFax , other similar services

• Often free from the dealer, you have to ask

• Check owner history, title information, maintenance information (that was done at dealerships), etc.

2. Mechanical Inspection

• If you aren’t the most mechanically inclined person, always have a mechanic check out the vehicle as an objective third party. These inspections are less than $50 and can save you thousands.

3. Visual Inspection

• Take the time to really comb over the vehicle for defects, scratches, stains, etc. This is the only time you will be able to negotiate and ask for the dealer to fix things on their dime.

4. Know What You’re Paying For

• The Purchase Order in the most important document in the car buying process (aside from loan paperwork). It will detail every penny of the transaction. Make sure you know what you are being charged for. The $250 documentary fee is industry standard.

GAP Protection, Extended Warranties, and other Products

1. GAP Protection Guaranteed Asset Protection: This “insurance” protects you if the vehicle is totaled for any reason (maybe 100%, not your fault) and ensures your loan/lease is paid off in full in that event. Vehicles depreciate quickly and the insurance company does not stay in business by paying out as much as possible. You should always strongly consider this unless you are putting 40%+ down on the vehicle. Always get when leasing.

2. Extended Warranties are Really another form of insurance. If you have mechanical breakdowns, the warranty will kick in and cover the costs (be careful to check for deductibles and exclusions). Also, keep in mind this does not cover maintenance.

3. Service Contracts are basically pre-paid maintenance contracts.

4. Other warranties Dealers offer warranties on just about everything (upholstery, etc. ), frankly most of the time these are not worth it.

Fuel & Maintenance Costs

Total Monthly Transportation Costs

1. Loan Payment or Lease Payment

(Downpayment /Length of Drivable)

+

2. Insurance Premium

+

3. Maintenance Costs Averaged on a Monthly Basis

+

4. Fuel Costs

⇒ Going back to our equation, we’ve covered the payment section.

⇒ You also need to budget for maintenance and fuel costs

⇒ There are great tools available online for this:

https://www.edmunds.com/tco.html

⇒ For a typical vehicle, this is going to be an additional $50 200 a month for maintenance, gas will vary greatly based on your vehicle and your commute.

Insurance Costs

Total Monthly Transportation Costs

1. Loan Payment or Lease Payment

(Downpayment /Length of Drivable)

+

2. Insurance Premium

+

3. Maintenance Costs Averaged on a Monthly Basis

+

4. Fuel Costs

⇒ Vehicle insurance costs are based primarily on the driver and the vehicle in question.

⇒ You can get quotes from most insurance companies in a few minutes online.

⇒ Be sure to analyze each of your coverages individually and get help if needed. Small differences can make a huge difference in premiums.

4 Important Tips at the Auto Dealership

1. Do not allow yourself to be sold on a payment. This is a common tactic that leaves out all the much more important numbers you need to consider.

2. Don’t be afraid to negotiate a bit for buying or leasing. It is true that with the internet there is much more transparency in car buying (and less haggling), that doesn’t mean prices aren’t negotiable at all. Keep in mind dealers do not make much money on the actual sale of a new car, so they may be unwilling to budge if they are not making money from you in other ways (financing, extended warranty, etc.)

3. Shop at the end of the month. Most salesmen have monthly quotas and dealers will consider things they wouldn’t normally do at the end of the month.

4. If you were pre-approved elsewhere and plan to finance outside the dealership, don’t necessarily advertise that fact. The dealer makes more money on the financing and add-ons than the car sale often, and this won’t help you negotiate.

Thanks to:

Jeremy Wascak

Director of Member Development @ Towpath CU

• Marketing/Sales Director at not for profit financial institution started out in corporate banking

• Personal Finance Nerd lack of financial education from school/parents/banks allowed me to make some poor decisions at a young age, forced me to learn & act to survive. Both my parents were bad with money in different ways. Never talked about it.

Bachelors in Business from Kent State top of my class in two ways: GPA and DEBT!

Student Loan Debt was my wake-up call. Have you had one? If not, you will!

I’ve read most of the top-selling personal finance books, online blogs, YouTube channels, etc.

Sara Urban

Marketing Manager @ Towpath CU

Other Posts:

- America’s Best Selling Luxury Car is Mercedes-Benz – Luxury Care

- U.S. light-vehicle sales closed out 2018 strong – Automotive News

- KIA & HYUNDAI ENGINE FIRE – Automotive News

- How Much Does Xzilon Cost? Xzilon Customer Reviews

- Waymo self-driving vehicles Test Result

- Auto Imports Tariffs Timeline On Foreign Cars

- Tax Credit For Electric Vehicle Owners – All States

Pingback: Can I Use Yoast and All In One SEO Together? - Affordable Webdesign